Our Blog

August 17, 2022

The $203 billion market, which formerly generated a number of trades each week and bloated portfolios for businesses like Pimco and UBS globally, is now all […]

May 27, 2022

If you’re like most people, you’d like to get your will in order and then not have to think about it again. However, this is a […]

April 20, 2022

In previous articles, we’ve touched on the phenomenon known as FOMO (fear of missing out). Fear of missing out can not only lead to dangerous spending […]

April 20, 2022

Keeping the details of one’s estate plans shielded from as many people as possible may seem like a great strategy for protecting one’s assets to many […]

April 6, 2022

A Review by Richard Cayne of Meyer International Ltd Thailand Even if it doesn’t payout directly, insurance is a very crucial investment. Whether it’s for your […]

March 28, 2022

Shares in a company represent units. One share is one unit of ownership in any given company. Owning shares in company provides an investor with certain […]

March 28, 2022

Previously, we touched upon share classes and the variety of rights towards owning sperate classes of a company’s shares. However, these all still represent types of […]

March 21, 2022

Cryptocurrencies, initial coin offerings and digital tokens all seem like the hottest thing in town lately. Although they may currently be all the rage, there are […]

March 14, 2022

A review by Richard Cayne from The Meyer Group in Bangkok Thailand Oftentimes, the headlines in the world of business will start barking about a possible […]

March 10, 2022

News outlets were buzzing in August of 2019 about the emergence of an inverted yield curve, screaming bloody murder that this was an absolute indicator of […]

February 25, 2022

One of the possible solutions for estate planning that we’ve discussed previously is trusts. Trusts aren’t just useful in helping to guard your assets against taxes, […]

February 23, 2022

Investors will generally find themselves understandably concerned during periods of severe economic conditions. primary reason for this is because any significant changes in economic factors will […]

February 1, 2022

One of the more confusing terms in the world of economics and finance is something called “Negative interest rate”. If a bank were to loan you […]

February 1, 2022

In past articles, we have covered trusts as a viable option when it comes time to delve into estate planning. There is a certain degree of […]

January 26, 2022

It’s extremely difficult to predict the perfect moment to sell or buy a stock. Sometimes even the most experienced veteran brokers, traders, analysts and financial experts […]

January 21, 2022

It would have been nearly impossible for anyone to have foreseen an event like COVID-19 coming with the magnitude it hit us with. Now we find […]

January 17, 2022

Financial planning is one of the many concerns that most people have as the COVID-19 health crisis continues onward throughout the world. While there are already […]

December 13, 2021

Everyone wants to be able to feel like they understand the world around them, particularly when something unthinkable as the COVID-19 pandemic occurs. At times, we […]

December 10, 2021

Everyone looks forward to the day where they will no longer need to work, but how many of us are actually prepared for retired living? Richard […]

November 19, 2021

I think it goes without saying that the COVID-19 pandemic has forced all of us to reassess and reevaluate so many aspects of our lives. Of […]

November 11, 2021

If you have a family, a life insurance policy and payment protection plans are essential investments for your future suggests Richard Cayne at Meyer International Ltd. […]

November 9, 2021

When the average person hears about something like “offshore” investing, they automatically imagine something sinister or dark, possibly even illegal, that people are using to dodge […]

October 27, 2021

There are those who believe that overall inflation rates will see a massive surge around the globe due to the economic strain and pressures brought about […]

October 12, 2021

Unicorns. No, not the magical horses with horns on their heads that gallop through the fantastical children’s fairy tales of old. I’m speaking about a different […]

July 1, 2020

Investing in any form can be risky, especially during volatile economic times such as now. We all want to see our portfolios grow, but how can […]

May 19, 2020

For many people, the concept of “investment portfolio” is something only available to certain types of people. And often they don’t include themselves in that group. […]

April 15, 2020

Many people look forward to retiring, but not many consider the option of retiring overseas. However, with proper consideration and planning, the potential locations to spend […]

March 2, 2020

When evaluating a company as a potential investment, there are so many factors to look at. One of them is the P/E ratio. This calculates the […]

January 28, 2020

When creating an estate plan, many decide to establish an entity to oversee their assets after they are gone, controlling the distribution of wealth and possibly […]

December 23, 2019

There are many tools and options when it comes to investment planning, especially for retirement. More often than not, you want an instrument that will guarantee […]

November 20, 2019

While some investors only look for opportunities to make a profit, there are those who also seek companies that align with their ethics. They tend to […]

September 17, 2019

Taxes, for most of us, are an inevitability. But how much tax you pay may differ depending on where your earning or profits come from. In […]

September 13, 2019

You go to the same destination every year for holiday, or you want to spend more time in some beauty spot — so you think, why […]

April 17, 2019

Bonds are touted by many as a low, almost no, risk investment. You put money in, and money comes out. Easy. But is it? As with […]

November 8, 2018

Initial public offerings (IPOs) can be fantastic for a growing company. It creates a new flow of capital without having to take out loans, offering stock […]

October 31, 2018

There has been a lot of press lately about plunges in cryptocurrency. Even Bitcoin, the trailblazer for the cryptocurrency craze, has seen an extraordinary plummet, so […]

August 20, 2018

Last year, we discussed some fundamentals when it comes to evaluating a company to determine whether it is a worthy investment. There are still so many […]

July 27, 2018

Some finance terms, like bull and bear to describe market trends, are meant to simplify concepts for the lay person trying to get to grips with […]

April 20, 2018

We’ve discussed the importance of not just saving money, but of how you need to assess your risk appetite as well as create specific financial goals. […]

March 21, 2018

Now that you’ve started to save, you need to consider what to do with your money. Keeping your cash in a savings account may seem safe, […]

March 21, 2018

It shouldn’t come as a surprise, but you should always be trying to save money. Of course, you don’t want to stay home every night, never […]

February 5, 2018

Recently, great news attention was given to the Dow Jones Industrial Average (DJIA) hitting 26,000 only to take a record drop a few weeks later. “Many […]

May 10, 2017

No one believes that they could ever be deceived into investing in a Ponzi scheme, but, as history has shown, even some of the most experienced […]

May 10, 2017

A common theme in this blog is the need to diversify your investment portfolio so that you can manage your exposure to risks. Technically, there is […]

April 11, 2017

You are constantly being told to diversify your portfolio to mitigate risk. Common instruments include stocks, bonds, and mutual funds, all of which have varying levels […]

March 4, 2017

In the current financial environment, some may think it is a bit of a waste to keep their liquid assets or available cash in low yield […]

February 27, 2017

Just because you don’t know the difference between Monet and Manet or between modern and postmodern doesn’t mean you should shirk the idea of investing in […]

February 27, 2017

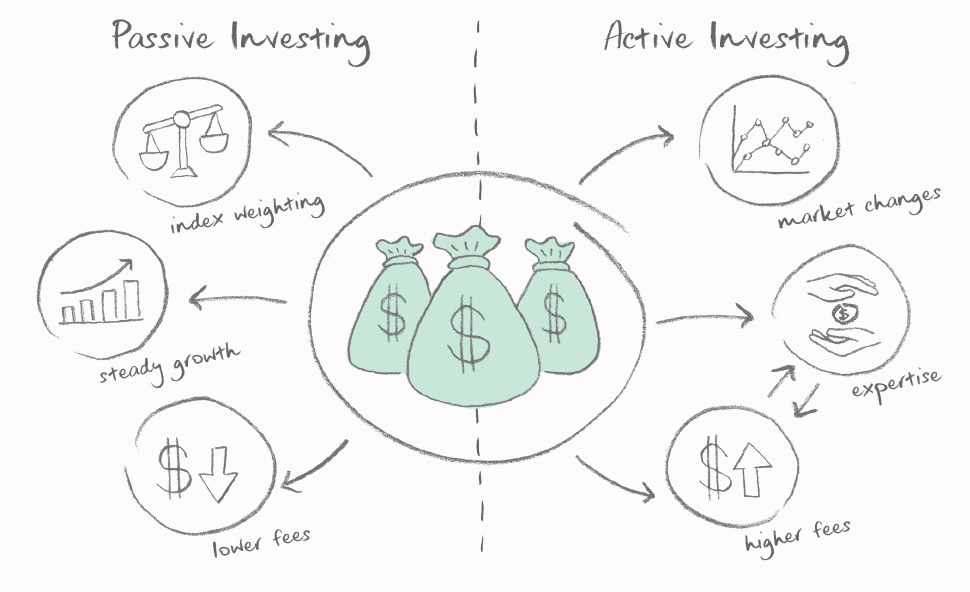

Last month, this article (http://www.richardcayne.com/richard-cayne-meyer/active-or-passive-does-it-really-need-to-be-eitheror/ ) discussed the general differences between active and passive investing. Now, it may seem to many that active investment management offers […]

January 30, 2017

You want to make sure that your investment choices are sound, but how can you make sure that your decisions will result in a gain? Between […]

January 30, 2017

You want to provide for your children, protect them, and give them all the luxuries you can afford. But eventually, they will need to understand that […]

November 26, 2015

Not every financial planner is a good financial planner. There are plenty of planners who got into the fields of wealth management or financial planning accidentally […]

November 26, 2015

You probably know some of the benefits of offshore accounts and investments. Investing in products in offshore jurisdictions provides a host of benefits from legal tax […]

November 9, 2015

Cultures differ throughout the world and some speak more openly than others. One topic that families can be very tight-lipped about is money. This can be […]

November 9, 2015

There are lots of mistakes that people might make when starting a business relationship with a financial planning consultant. Maybe you aren’t organized, you give goals […]

October 21, 2015

What comes to your mind when someone mentions offshore investing? Something sordid? Swiss numbered bank accounts and bad guys from James Bond films? Maybe you think […]

October 21, 2015

“International investing?! Oh no, I would never!” “That’s just wrong.” “It’s not safe.” “I’m too careful for that.” These are just a few of the reactions […]

October 21, 2015

Are you living in Thailand? Have you been here for a while? Maybe you’ve made some great friends in the city, enjoyed trips to the islands […]